1099-NEC

The 1099-NEC

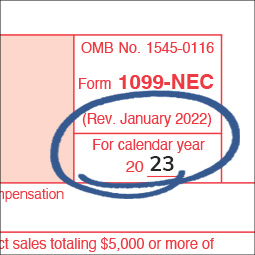

The NEC still uses a revised format, smaller envelope size, and is a continuous use form, good for multiple years.

NEC or MISC—Which Form(s) Do You Need?

What exactly is non-employee compensation? And what payments need to be reported on the 1099-MISC? Our quick guide gives you the highlights.

| What are you reporting? | 1099-NEC | 1099-MISC |

|---|---|---|

| Paid over $600 in compensation to an attorney or person who is not your employee for services | ||

| Paid an individual, partnership, estate or in some cases, a corporation | ||

| Paid an individual, partnership, estate or in some cases, a corporation | ||

| Rental income | ||

| Royalties, awards & prizes | ||

| Fishing boat or crop insurance proceeds | ||

| Medical and health care payments | ||

| Substitute payments in lieu of dividends or interest | ||

| Excess golden parachute payments | ||

| Excess golden parachute payments | ||

| Payer-made direct sales of $5,000 or more | ||

| Shop NEC | Shop MISC |

The 1099-NEC is still continuous use.

An undated form means a simpler tax year.

The IRS released the continuous use version of 1099-NEC in 2022. The form is still used to report unemployment compensation to payees, but the 1099-NEC is undated, so it can be used for multiple tax years.

New IRS eFile Law! If you’re filing 10 or more forms, you must eFile! For more information, visit our Tax Tips

Avoid Penalties

Watch out for these stumbling blocks as you navigate this tax season. Proceed with confidence and caution. Mistakes can be costly.

For some categories, it’s easy to be confused.

You must report attorney’s fees on the 1099-NEC.

You report gross proceeds to attorneys (from lawsuits) on the 1099-MISC.

For full details, see our IRS Resources page with links to IRS Information Sheets.

DON’T file late or fail to file

There are no automatic extensions for the 1099 NEC. The IRS may grant one 30-day extension for an extreme hardship (a death or catastrophic event). Otherwise, fines for filing late range from $50 to $270 per 1099. Intentionally filing late can result in penalties of $560 for each unfiled form.

Still uncertain?

Here are additional resources to help you find the right form.

IRS Resources

Access our hub for IRS deadlines and links to IRS Information Sheets.

See IRS Resources